New energy vehicles bring about changes in power semiconductor applications

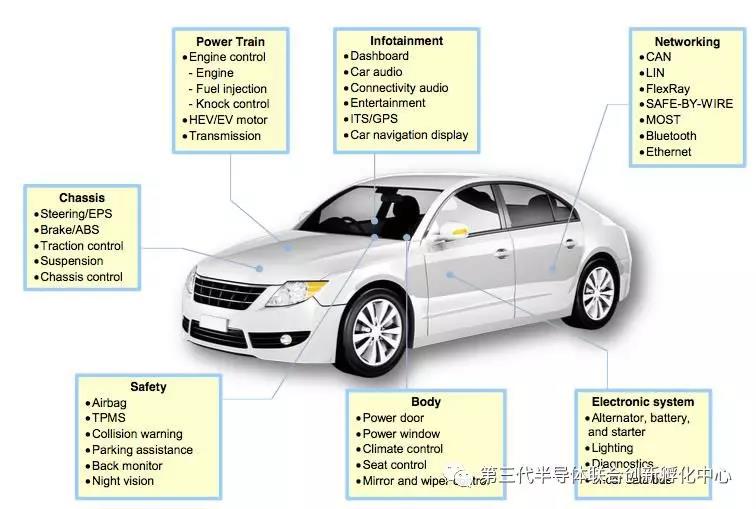

With the continuous transformation of information technology and automobile, the change of internal structure of automobile brings the increase of value of electronic parts.It is not just the growth of electric motors, electronic controls and batteries that will result.From the perspective of internal components, automotive semiconductor upgrade space is vast.

The greatest amount of semiconductor devices in automobiles fall into three main categories: sensors, MCUS, and power semiconductors.

Among these three types, MCU has the largest market share, followed by power semiconductor, which is mainly used in power control system, lighting system, fuel injection, chassis safety and other systems.

Most of the newly added semiconductor consumption of new energy vehicles is power semiconductor.In traditional automobiles, power semiconductors are mainly used in startup and power generation, safety and other fields, accounting for 20% of the total semiconductor volume in traditional automobiles. The value of a bicycle is about $60.

▼ power semiconductor

applications in cars

According to McKinsey, the semiconductor cost of a pure electric car is $704, double the $350 cost of a conventional car, Among them, the cost of power device is as high as $387, accounting for 55%.Power components cost about $269, accounting for 76% of the added semiconductor costs for pure electric vehicles compared to conventional vehicles.

Power semiconductor devices are the core components to achieve power conversion.

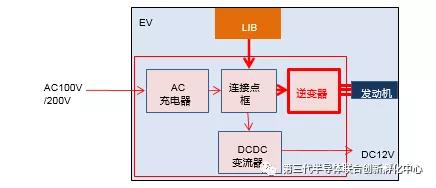

New energy electric vehicles will no longer need gasoline engines, fuel tanks or transmissions.The key components that determine the performance of an electric car are the motor, the PCU, and other core electrical components.The power module contains on-board chargers, inverters, converters and other electrical equipment, all of which contain power semiconductors.

Inverter

Electric

cars are equipped with large rechargeable batteries that use stored energy to

drive electric motors and power the car.Rechargeable

batteries cannot be connected directly to the motor, they are usually connected

by the motor inverter, referred to simply as the inverter.The inverter usually converts the dc of DC12V to ac of

AC220V, which is the same as the mains.

▼ The inverter in an electric

car

Source: electronic components technology network, tianfeng securities research institute

Car charger

Ac charging piles providealternating current (ac100v-240v), while high-voltage lithium-ion batteries(LIB) need to be charged with DC (DC), so the charger must have a DCconverter.On-board chargers typically range from 85V to 265V, allowing thevehicle to be charged anywhere in the world.A large number of power transistorsare used as power switching devices in car chargers.The power transistorincludes bipolar tube, MOS tube and IGBT.

▼ The charger works in an electric car

Source: electronic components technology network, tianfeng securities research institute

The qualitative change of power semiconductor brought by new energy vehicle

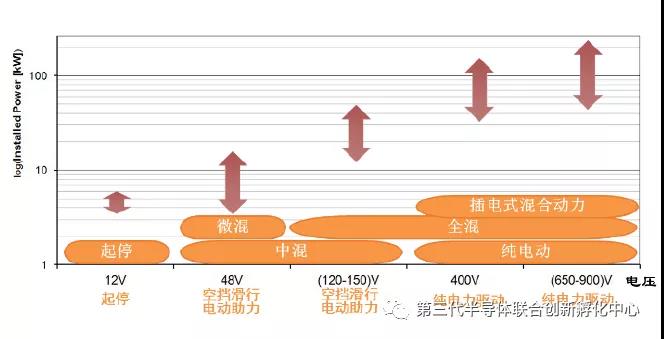

The main function of the electric power system of different new energy vehicles is different. The electric power system of medium and micro hybrid vehicles mainly provides electric power when idling and taxiing, while the main function of the electric power system of full hybrid or pure electric vehicles is to provide electric drive.On the one hand, due to the different main functions of the power system, the operating voltage and power range of different new energy vehicles vary greatly.The voltage of a mid-hybrid car is typically below 150V, while that of a full-hybrid pure-electric car is over 400V or higher.On the other hand, different power semiconductors have different operating voltages. IGBT is suitable for high voltage operation, while MOSFET is suitable for low voltage operation.In the electric drive system, IGBT is used for the inverter module, which converts the dc of the battery to ac to drive the motor.In the power supply system, IGBT is used in various ac/dc and dc/dc converters to charge the battery and complete the required voltage level of power conversion.At the same time, IGBT also needs to be used extensively in charging piles of new energy vehicles.Therefore, the use of IGBT/MOSFET in automotive power semiconductors is increasing due to the new energy vehicles, and there are more and more kinds.

▼ operating voltage power distribution of different new energy vehicles

Source: MUMSS, tianfeng securities research institute

▼IGBT and MOSFET working features

Source: EEWorld, tianfeng securities research institute

Source: EEPW website, tianfeng securities research institute

IGBT - silicon - based power semiconductor core

IGBT module plays a crucial role in electric vehicles, and is the core component of electric vehicles and charging piles.Statistics show that IGBT modules account for nearly 10% of the cost of electric vehicles and about 20% of the cost of charging piles.

IGBT is widely used in automotive motor control system, at present, the automotive motor control system needs to use dozens of IGBTs.Taking tesla as an example, 28 IGBTs are used for each phase of the three-phase ac asynchronous motor after tesla, a total of 84 IGBTs are used. adding the IGBTs in other parts of the motor, a total of 96 IGBTs are used by tesla (36 IGBTs are also used for the dual motors). According to the price of 4-5 dollars per unit, the dual-motor IGBT costs about $650.

IGBT (InsulatedGateBipolarTransistor), also known as the insulated gate bipolar transistor, it combines the advantages of the traditional metal oxide field effect transistor (MOSFET) and semiconductor transistor (BJT). Higher input impedance and stronger current carrying capacity, which widely used in high voltage converter system, such as ac motor, power transmission, lighting circuit, traction drive and so on.

Fifth and sixth generations of components are advanced products after IGBT has experienced the technological innovation for several times, the comprehensive indexes increase obviously, especially the sixth generation IGBT chip of silicon wafers with thinning process will Punch-Through instead of Non-Punch Through structure, work under voltage levels up to 6500 v, There has been a huge leap in performance (in actual products, the sixth-generation optimization coefficient can be 30% higher than the fifth-generation).The operating frequency of IGBT devices occupies a dominant position in the application range of medium voltage and medium current power semiconductor devices, and the output power can reach megawatt level.

In recent years, the rapid development of electric vehicle industry has provided a strong market demand for key parts such as motor controller, auxiliary power supply (DC/AC, DC/DC, charger) and so on. Meanwhile, IGBT which is the core component in the downstream industry chain, has also ushered in a good development opportunity.

In terms of structure, IGBT has one more P+ region than MOSFET, The conduction resistance of the device can be reduced by injecting holes in P layer.With the increase of voltage, the conduction resistance of MOSFET also increases, so its conduction loss is relatively large, especially in high voltage applications. By contrast IGBT has a relatively small on - off resistance.

▼(a) MOSFET structure;(b) IGBT structure drawing

Source: ElectronicDesign, skywind securities research institute

In the on-board parts, the motor controller inverts the direct current of the energy storage system to the three-phase alternating current, and controls the drive motor according to the vehicle demand to provide the basic driving force for the new energy vehicle.At the same time, when the vehicle is braking, the kinetic energy is converted into electrical energy to the energy storage system, which is the main energy conversion device.It not only has heavy load and high control precision requirements, but also takes into account the voltage level, power level, limit environment, power density, service life, control cost and other requirements of electric vehicles. For the needs of electric vehicle operation, IGBT chips for electric vehicles are being developed for miniaturization, shock resistance, low loss, high temperature resistance, higher safety and intelligence.

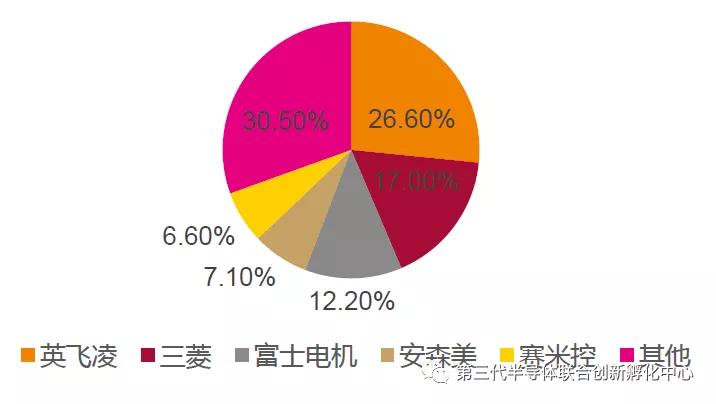

Foreign advanced enterprises such as infineon, Fuji and mitsubishi have developed IGBT chips for the new generation of electric vehicles, and the domestic market share of IGBT products is still relatively low. Zhuzhou CRRC era electric has developed 1700V ~ 6500V series IGBT products and realized commercial use in rail transit, smart power grid and other fields. On this basis, it has developed T5 generation 750V / 200A, 1200V / 200A and 750V / 300A specification double-sided weldable IGBT chips suitable for the application of electric vehicles, which are currently at the leading level in China.Huahong hongli's IGBT chips based on 6-inch and 8-inch flat and grooved 1700V, 2500V and 3300V have entered mass production.

The main market share of IGBT in China is monopolized by overseas enterprises such as the United States, Japan and Europe. Starpower, headquartered in jiaxing, zhejiang province, is the largest IGBT module manufacturer in China. In 2016, starpower occupies 2.5% of the global market share in IGBT module field, ranking 9th in the world.

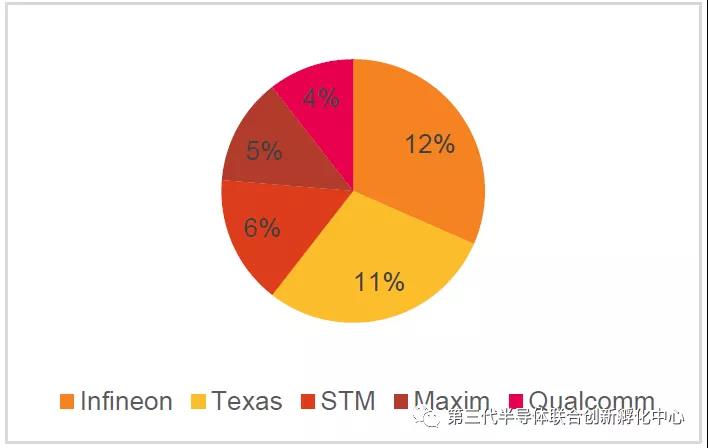

▼ Global IGBT semiconductor market share in 2016 (%)

Source: IHS, tianfeng securities research institute

The power semiconductor market is basically monopolized by overseas enterprises, and there is a wide space for domestic enterprises to replace

Although the power semiconductor industry is important and large, the main suppliers are concentrated in the United States, Japan and Europe.The United States is the birthplace of power electronic devices and occupies an important position in the global power electronic device market.Since the 1990s, Japan has become a developed region in the international power electronic device industry, with major device enterprises including Toshiba, Fuji and mitsubishi.Europe is also a developed region of the global power electronics industry, with major enterprises such as infineon, ABB and Semikron.U.S. automakers typically source from Japanese auto parts suppliers.Gm supplies parts from Hitachi AMS and TDK, while ford buys transmission related parts from Toshiba.As far as hybrid electric vehicles are concerned, Japanese automobile manufacturers have a higher level than the United States. The strategy of American enterprises is to purchase parts from Japanese suppliers in a short term and develop their own parts in the meantime, so as to gradually carry out production substitution. This has played a good demonstration role in the substitution of domestic parts for domestic automobile enterprises.

▼ Power semiconductor market major participating manufacturers

Source: corporate website, tianfeng securities research institute

Among Japanese automakers, Toyota produces a high percentage of all these parts in-house.Honda produces a high proportion of driveline-related components internally, External sourcing of battery and converter related components. Priority is given to the production of electric motors and inverters inside Nissan, and other parts are purchased from Japanese domestic suppliers. Mitsubishi motors and Mazda get their core parts mainly from external sources.

Among European carmakers, GM buys a higher proportion of external parts, mainly from ZF and Bosch.TDK has a long history of supplying converters to European carmakers, and panasonic of Japan has a share of the market for lithium-ion batteries.Hitachi AMS supplies motors and inverters to carmakers in the us and Europe.

The core of hybrid, plug-in and electric cars, the drive motors are made internally by major Japanese automakers such as Toyota, Honda and nissan, while Mazda and Fuji heavy industries make cars from Toyota.The electronics makers also have a track record of supplying foreign carmakers: Hitachi AMS supply general motors, Toshiba supply ford, and Japan electric supply Daimler.

Hitachi and mitsubishi electric have a long history as heavy motor manufacturers and have excellent technology in this area, but the motor development market is expanding at a cautious pace.

Inverters and inverters help control the voltage of the entire vehicle.They are called power control units (pcus).Toyota makes its own PCU for its core model, and in the case of the prius, either the company makes its own IGBT, substrate, chassis, dc-dc converter, or Toyota makes it.Honda assembles PCU, nickel metal hydride batteries, lithium-ion battery packs and battery balance ECU for its hybrid, plug-in hybrid and electric vehicle smart power units (IPU).

Honda fit's IPU contains externally sourced parts such as mitsubishi electric's inverter and TDK's dc-dc converter.Honda motor has a close business relationship with mitsubishi electric.Inverter is the most important part of PCU and IPU, which is composed of IGBT and other power devices.Toyota and prius use inverters made by Fuji motors.The Honda Insight series uses inverters from mitsubishi motors, while the mitsubishi iMiEV series uses inverters from Hitachi.

In dc-dc converters, Toyota industrial and denso supply Toyota vehicles.Denso and panasonic supply dc-dc converters to nissan.TDK, ShindengenElectric, Toyota industrial and denso supply Honda cars.Among electronics makers, nikon supplies dc-dc converters to Mazda and mitsubishi motors.In addition to supplying Honda and other Japanese automakers, TDK has a track record of supplying general motors, ford and Volkswagen.Hybrid, plug-in hybrid and electric car batteries are procured by a number of joint ventures formed between carmakers and battery manufacturers to hone their development's competitive edge.

China's power semiconductor market in the high-end MOSFET and IGBT mainstream device market, the main share depends on imports, is basically monopolized by foreign European, American, Japanese enterprises, domestic enterprises replacement space is very broad.

▼Global power semiconductor market size / $100 million from 2016 to 2022

▼ Global power semiconductor market competitive pattern

Source: electronic engineering world, tianfeng securities research institute